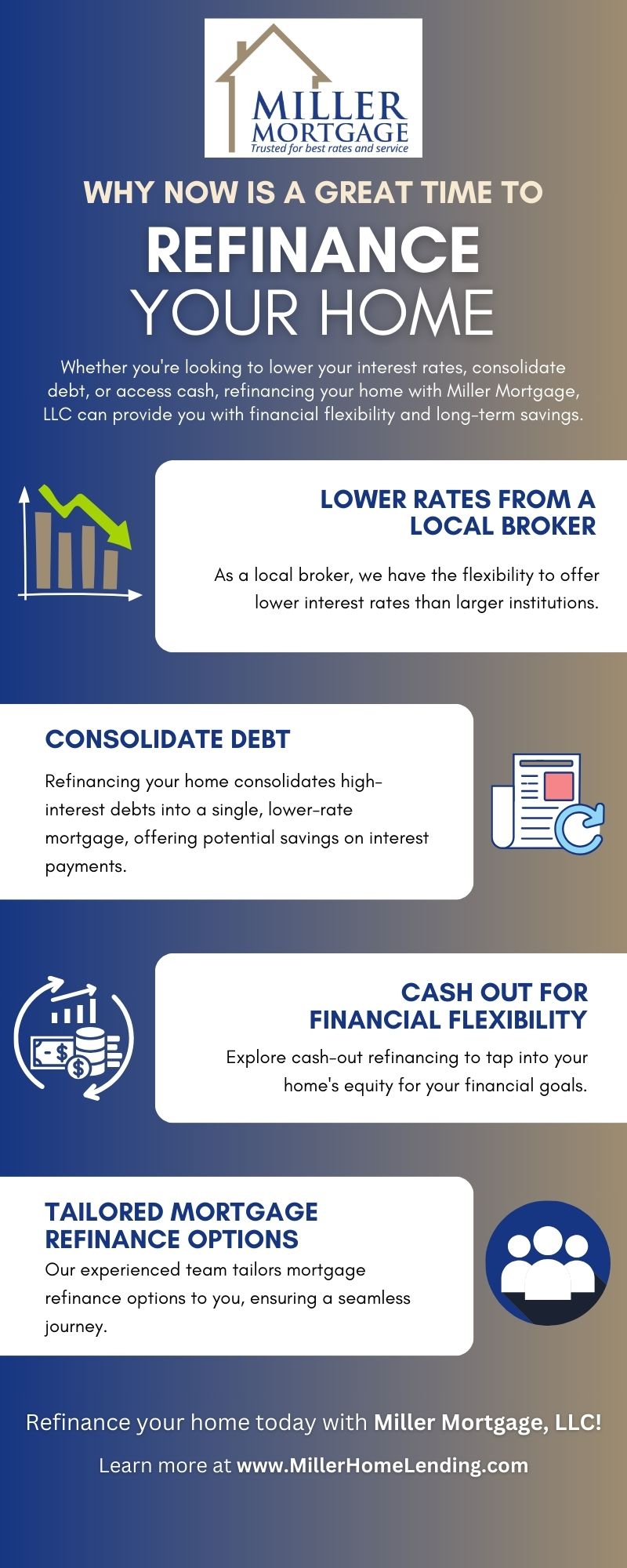

If you’re a homeowner looking to reduce your interest rates, consolidate debt, or access cash, now is a great time to consider refinancing your home. At Miller Mortgage, LLC in Essex County, MA, we understand the importance of securing the best refinance home loan options for our clients. With our low mortgage rates, exceptional customer service, and years of industry experience, we are here to help you make the most of this favorable market. In this blog, we will discuss four compelling reasons why now is the perfect time to refinance your home.

Lower Rates From a Local Broker

One of the primary benefits of refinancing your home is taking advantage of lower interest rates. As a local broker, Miller Mortgage, LLC has the flexibility to offer competitive refinance rates that are often lower than those of larger institutions. By refinancing with us, you can secure a mortgage loan refinance with lower interest rates, resulting in substantial long-term savings.

Consolidate Debt to Improve Your Financial Situation

If you have accumulated high-interest debt, such as credit card balances or personal loans, refinancing your home can be an effective way to consolidate your debts. By rolling these debts into your mortgage, you can benefit from a lower interest rate and a single monthly payment, making it easier to potentially save money in interest payments.

Cash Out for Financial Flexibility

For those seeking financial flexibility, a cash-out refinance presents a viable solution. Cash-out refinancing options allow you to tap into your home’s equity for various purposes, such as home improvements, education expenses, or other financial goals.

Explore a Range of Mortgage Refinance Options

We specialize in providing tailored mortgage refinance options that align with your unique financial goals. Our experienced team ensures personalized attention, considering factors such as your current mortgage terms, credit profile, and long-term objectives.

With lower interest rates from a local broker, the ability to consolidate debt, access cash, and an array of mortgage refinance options, now is an ideal time to consider refinancing your home. As a trusted and experienced mortgage broker, Miller Mortgage, LLC is committed to assisting you in securing the best refinancing terms and helping you achieve your financial goals. Contact us today for personalized guidance and support in Essex County, Massachusetts!